Women Karta: 1 Landmark Shift in Hindu Undivided Family Law

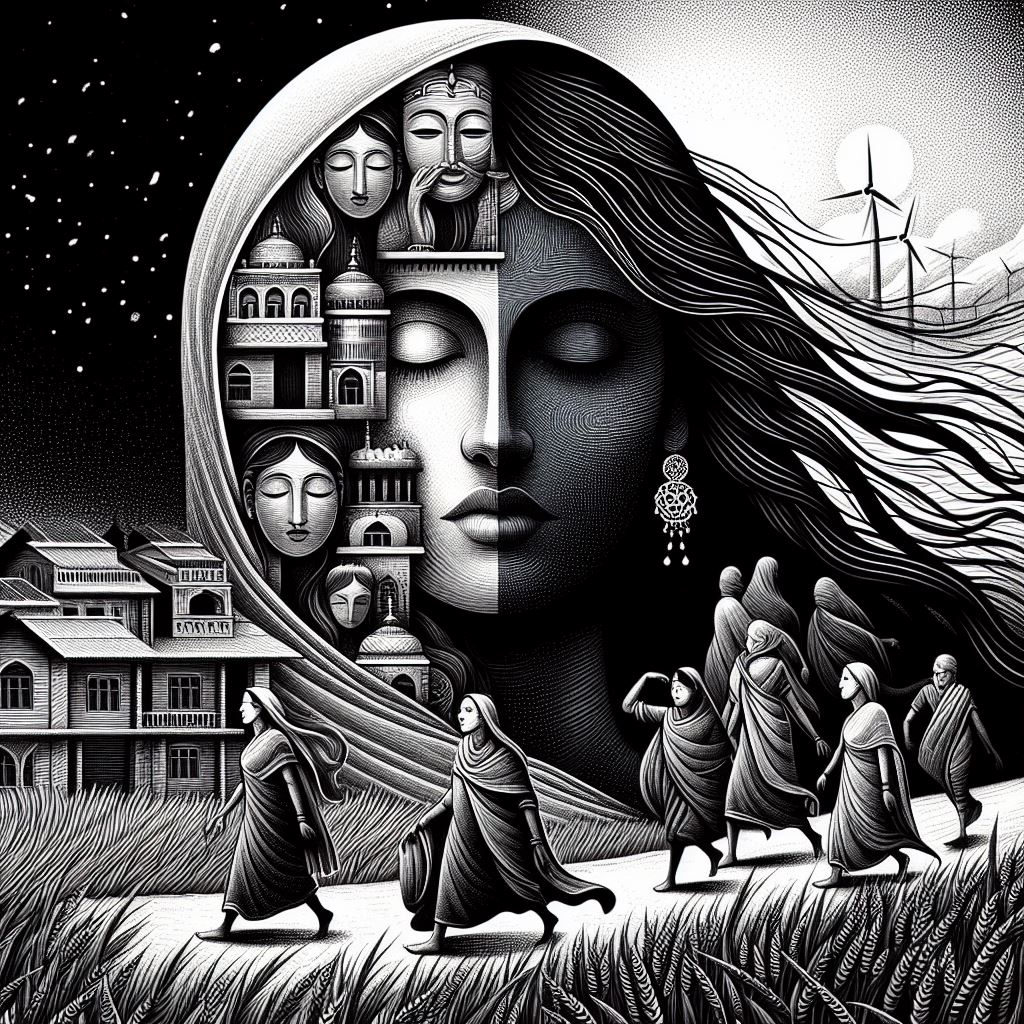

The rise of women Karta represents a significant shift in Indian society. It is a testament to the growing awareness of gender equality and the increasing empowerment of women. The rise of women Karta could lead to an increase in the number of HUFs in the future.

With more women empowered to establish and manage families, it’s likely that the utilization of HUFs as a tax-planning and family management tool will become more widespread. With more women taking on leadership roles within families, awareness of HUFs and their benefits is likely to increase. This knowledge could encourage families to explore forming HUFs as a viable option for managing their finances and property. HUFs offer multiple tax benefits, including separate tax identities from individual members, lower tax rates, and increased deduction opportunities.

Women Karta, being financially empowered and aware of these benefits, might be more inclined to utilize HUFs for tax planning purposes. HUFs offer advantages in inheritance and succession planning by allowing coparcenary rights for all members, including daughters. This could empower women Karta to ensure fairer distribution of family wealth across generations and protect the financial security of female members.

Sharing my recent article on HUFs below which demystifies the formation of a HUF, exploring its benefits and tax implications.

Please click the Here to read the complete article.

Women Karta: 1 Landmark Shift in Hindu Undivided Family Law Read More »