The Income Tax Bill 2025, introduced by Finance Minister Nirmala Sitharaman on February 13, 2025, aims to overhaul India’s six-decade-old tax framework by simplifying and modernizing its provisions. This new legislation is designed to enhance clarity, reduce complexity, and make tax compliance more straightforward for taxpayers.

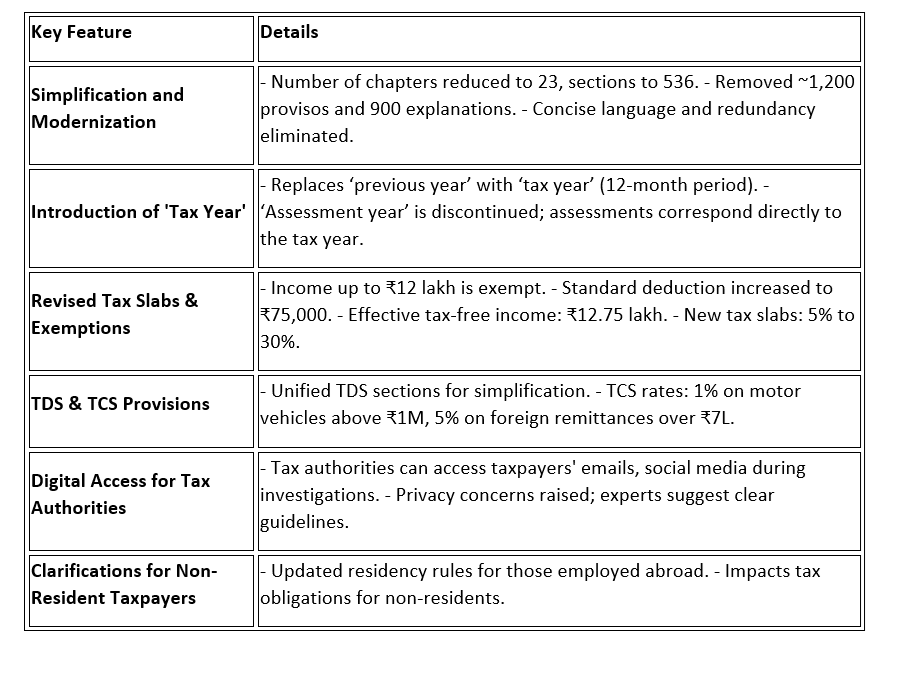

Key Features of the Income Tax Bill 2025:

- Simplification and Modernization:

Streamlined Structure: The bill reduces the number of chapters to 23 and sections to 536, eliminating approximately 1,200 provisos and 900 explanations to enhance readability.

Concise Language: Redundant sections have been removed, and related content consolidated, making the law more concise and user-friendly. - Introduction of ‘Tax Year’:

Definition: Replaces the term ‘previous year’ with ‘tax year,’ defined as a 12-month period within a financial year.

Assessment Alignment: The term ‘assessment year’ is discontinued; assessments will now correspond directly to the ‘tax year. - Revised Tax Slabs and Exemptions:

Increased Exemption Limit: Income up to ₹12 lakh is exempt from taxation, with a standard deduction of ₹75,000, effectively exempting income up to ₹12.75 lakh.

Updated Tax Rates: New tax slabs have been introduced for incomes above ₹12.75 lakh, with rates ranging from 5% to 30% - Tax Deducted at Source (TDS) and Tax Collected at Source (TCS) Provisions:

Consolidation: TDS provisions are unified under a single section for simplicity.

Specific TCS Rates: Applies to transactions such as the sale of motor vehicles above ₹1 million (1%) and foreign remittances exceeding ₹700,000 (5%). - Digital Access for Tax Authorities:

Expanded Powers: Tax authorities are granted broader access to taxpayers’ electronic records, including emails and social media accounts, during investigations.

Privacy Safeguards: Experts emphasize the need for clear guidelines to balance investigative powers with taxpayer privacy rights. - Clarifications for Non-Resident Taxpayers:

Residency Criteria: The bill refines the definition of non-residents, particularly for individuals employed abroad, affecting tax obligations and residency status.

The Income Tax Bill 2025 represents a significant step toward a more transparent and efficient tax system in India, aiming to reduce ambiguities and facilitate easier compliance for taxpayers.

The Income Tax Bill 2025 reflects a major shift in India’s tax framework, focusing on simplification, modernization, and digital integration. Here’s what it indicates:

- Clarity and Simplification:

The government aims to make tax laws more accessible and understandable by removing outdated provisions and redundancies.

By reducing chapters, sections, and complex language, it lowers compliance burdens for individuals and businesses. - Structural Changes in Taxation:

The introduction of the ‘Tax Year’ eliminates confusion between the previous year and the assessment year.

New tax slabs and increased exemptions indicate a move towards a progressive tax structure, benefiting the middle class. - Enhanced Digital Tax Enforcement:

Greater access to digital records (emails, social media, and devices) signals a stronger focus on curbing tax evasion and increasing transparency.

However, this raises privacy concerns, which require clear legal safeguards. - Rationalization of TDS & TCS:

The unification of TDS provisions under one section suggests an easier compliance process for businesses and taxpayers.

Changes in TCS rates indicate a push towards better tax collection efficiency, especially in high-value transactions. - Focus on Non-Resident Taxpayers:

The residency rule clarifications suggest the government is tightening tax laws for Indians working abroad, possibly to prevent tax avoidance. - Economic and Political Implications:

This bill aligns with India’s digitization drive and ease of doing business agenda.

It also reflects the government’s pro-technology, pro-compliance, and anti-tax evasion stance. - Overall Reflection:

The Income Tax Bill 2025 is a significant step toward a modern and efficient tax system, making taxation simpler, more transparent, and digitally driven. However, privacy concerns, enforcement clarity, and practical implementation will determine its success.

The Income Tax Bill 2025 brings a mixed impact, benefiting some taxpayers while increasing the burden on others. Here’s a breakdown of who gains the most and who might face challenges:

Most Beneficial Taxpayers/Sectors

- Middle-Class Salaried Individuals

Why?

-Increased tax exemption up to ₹12 lakh (+ standard deduction of ₹75,000) means lower tax liability.

–Simplified tax slabs with more clarity.

Who benefits the most?

-Salaried individuals earning ₹12–15 lakh per year

– Retired individuals with pension income - Start-ups & Small Businesses

Why?

– Easier compliance with streamlined TDS/TCS provisions

– Possible lower tax rates for MSMEs, promoting entrepreneurship

Who benefits the most?

– Small business owners, freelancers, and professionals under the new simplified structure. - Real Estate & Infrastructure

Why?

– Tax incentives on property transactions may encourage investments

– Lower TDS compliance burden simplifies operations

Who benefits the most?

– Homebuyers, real estate developers, and infrastructure companies

Worst-Hit Taxpayers/Sectors

- High-Income Earners (₹50 lakh+)

Why?

– Higher tax rates imposed on the highest slabs

– Stricter enforcement to curb tax evasion

Who gets impacted the most?

– Business executives, corporate professionals, and HNIs (High Net-Worth Individuals) - Non-Resident Indians (NRIs)

Why?

– Stricter residency rules may increase tax liability for those working abroad

– Uncertainty about foreign income taxation

Who gets impacted the most?

– NRIs working in tax-free countries (UAE, Singapore, etc.)

– Indians with foreign investments and remittances - Digital & Online Business Sector

Why?

– Increased digital scrutiny (tax authorities accessing emails, social media).

– Stricter compliance rules on online transactions

Who gets impacted the most?

– Freelancers, e-commerce sellers, influencers, and content creators

Conclusion: A Mixed Bag

Winners: Middle-class salaried employees, start-ups, MSMEs, and homebuyers.

Losers: High-income earners, NRIs, and digital entrepreneurs.

Summary

The Income Tax Bill 2025 brings a progressive shift in India’s taxation system, balancing simplification, modernization, and enforcement. While it provides major relief to middle-class taxpayers, start-ups, and small businesses through higher exemptions and streamlined compliance, it imposes stricter rules on high-income earners, NRIs, and digital entrepreneurs.

The bill aligns with the government’s vision of enhancing tax transparency and boosting economic growth, but its success will depend on effective implementation and addressing privacy concerns. Overall, it marks a step towards a more structured and digitally integrated tax system, but its long-term impact will be seen in how businesses and individuals adapt to the changes.

©CS SHIKHA PUBBI

Practicing Company Secretary

Shikha Pubbi & Associates (SPCS)

https://spcsfirm.in/

Disclaimer: While the information presented in this article is based on factual sources, the interpretation and opinions expressed are solely those of the author.

Sources:

- News Papers: Indian Express, Live Mint and Economic Times

- India Briefing

- Reuters